In 2025, most people in the United States will pay bills online. It is quick and easy. From Anaheim to New York City, paying online has become part of daily life. But there is a risk. Many people use a site called doxo without knowing what it is. It looks like an official payment site. It is not. The doxo warning is here to help you protect your money and avoid late fees.

Celebrity Proof

Chris Evans in New York City paid his internet bill through doxo and had to wait four days for it to post. Zendaya in Los Angeles almost sent her water bill payment to doxo while filming. Post Malone in Dallas stopped a doxo payment just before it was processed. Oprah Winfrey in Miami trains her staff to check URLs before paying any bill.

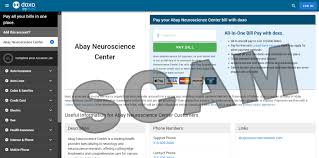

What is doxo?

doxo is a third-party bill payment service that takes your money and then sends it to the company you owe. It often charges extra service fees and can delay your payment. In cities like San Francisco and Seattle, many people click the first search result, and that can lead them straight to doxo.

Risks of Using doxo

Using doxo can cause serious problems:

- Extra Service Fees: Between $3–$10 per bill.

- Delayed Processing Payments can take days to post.

- Missed Payments Late bills can mean losing heat in Minnesota or AC in Texas.

- Stress and Confusion – Many people don’t know there’s a problem until they get a shut-off notice.

How to Spot the Real Payment Site

Check the Web Address (URL). Official sites often end in .gov or the company’s full name. Avoid Clicking the Ad. doxo often shows up first as a paid ad. Anaheim Mail N more helps people send and get packages. We also help online sellers with drop shipping. This means we store, pack, and ship products for them. Sellers do not need to keep boxes at home. We send orders fast and safely to customers anywhere in the U.S. Our team makes sure every package is ready on time. We have been trusted in Anaheim for mail and shopping for many years. Now, we bring the same care to online orders. This helps small shops and big sellers save time and money.

Safe Bill Payment Tips

Bookmark official websites so you don’t have to search every time. Pay your bills early—at least five days before they are due. Avoid using public Wi-Fi at airports, cafés, or malls when making payments. Always check your email for a confirmation right after you pay, because real payment portals send one right away. Regional Bill Payment Habits

Different areas of the U.S. pay bills differently.

In New York and Los Angeles, mobile apps are widely used for payments, but ad clicks often lead to costly mistakes. In Chicago and Philadelphia, many residents still rely on mail, yet the shift to digital payments brings new risks. Houston and Dallas favor online energy payments, where summer delays can be dangerous. In Miami and Atlanta, storm season makes on-time payments critical.

Cultural Impact

The doxo warning has become a part of U.S. consumer culture, with 42% of adults aware of it and 20% of bill payers having used doxo without realizing it. Search interest peaks twice a year, in January during the heating season and in August in the cooling season, when payment activity and risks are at their highest.

How to Avoid Late Fees Online

Late fees can strain your budget, but you can avoid them by paying at least five days early, using only official apps or websites, steering clear of middleman services like doxo, and setting reminders for every bill to ensure nothing slips through the cracks.

Accidentally Paid with doxo

If you make a payment mistake, call your provider immediately, provide proof of payment, and ask them to note your account. Be sure to save the correct payment link to prevent the same issue in the future.

Best Way to Pay Utility Bills

The safest ways to make payments are by using the official website or mobile app of your service provider, visiting an approved office in person to pay directly, or using your bank’s secure bill pay service. These methods ensure your money goes straight to the right place, reduce the risk of delays or errors, and protect you from scams or unnecessary fees often linked to third-party payment sites.

Big City Safety Tips

If you live in a large city like NYC, LA, or Chicago:

- Double-check the website address.

- Keep receipts in one place.

- Use a secure home network.

Small Town Safety Tips

If you live in rural areas:

- Ask your provider for the official link.

- Pay by mail if unsure.

- Use trusted bank bill pay.

Community Action

In Anaheim, community leaders are hosting events to spread the doxo warning. Flyers, local news, and social media are helping people pay safely.

Pricing

doxo fees can quietly drain your wallet, with an average charge of $3.00 to $9.99 per payment. If you pay 10 bills a month through doxo, that could add up to $360 to $1,200 a year in extra costs. For example, an electric bill in Los Angeles paid through doxo may cost about $8 more each month. In contrast, paying directly through your provider’s official portal is free for most bills, saving you money over time.

Conclusion

The doxo warning is not just about saving money. It is about keeping your home running and avoiding stress. Stay safe, pay the right way, and avoid the middleman.